In April this year, I gave a presentation to the Trueventus Airport Retail conference in Singapore posing the question “How Much Retail Space is Enough for Airports?”

What followed was truly amazing. I posted the title of the presentation and an offer to send people a copy onto my LinkedIn account. The post received more than 85,000 views and requests for a copy of the presentation are still pouring in all these months later.

Clearly, the topic of the presentation struck a chord with a lot of people. Everybody wants to know how much retail should be in an airport terminal.

Of course, there are many perspectives to this sort of question. Some people thought I was calling for a cease-fire on the provision of shops and F&B at airports (kind of like enough-is-enough already). These are probably the people that spend all of their time at airports in airline lounges.

But the majority of post viewers had a professional interest in the answer – airports, architects, planners, retailers and brands. They all genuinely want to know how much space airport terminals can sustain.

One way to answer the question is to look at benchmarks – how much retail space do airports currently provide in terminals? Indeed, in the first Airport Retail Study I published in 1998 (now published by The Moodie Davitt Report as the Airport Commercial Revenues Study) we pioneered and published the measurement of retail space per thousand passengers.

What we have learnt since then is that the amount of retail space per thousand passengers has been increasing over the past two decades.

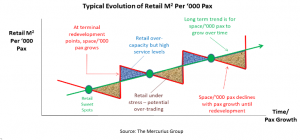

The chart below highlights the typical evolution of retail space per thousand passengers at airports. As the provision of additional space at airports is lumpy – mostly restricted to periodic upgrades and expansions – the actual amount tends to go up and down as depicted in the red line. Retail space per thousand passengers typically goes up at the point of terminal development and then falls over time in line with traffic growth until the next redevelopment point. But the thing to observe is the green line – the trend line over time. Over the period of the past two decades, the amount of retail space airports are providing passengers is going up.

Source: The Mercurius Group

Why is that? Well, there are a number of reasons.

First, as traffic grows at an airport, you can sustain more retail categories. For example, just about every airport can sustain a news/gift concession (although such stores are now more akin to convenience stores than news/gift stores) as just about one in every two or three passengers buys something from such a store. But you need a lot of passengers to sustain retail formats like fashion accessories where only one in 20 might buy or high end luxury or celebrity chef restaurants where only one in 50 might buy.

Second is simple financial mathematics. Specialty retail and F&B at airports can typically generate $2,000-3,000/m2 per year in rental returns. When the cost to build incremental square metres of retail space might only be $5,000-$6,000, it seems a no-brainer to increase the retail floor space until the marginal returns from incremental space equals the marginal cost. And on these numbers, we are still a fair way away from reaching that point.

But the third reason is the most important. It is the evolution of the maturity of airports as retail mall managers and owners. This allows us to look not only at what has been achieved elsewhere (i.e. benchmarks) but to start thinking about what is possible.

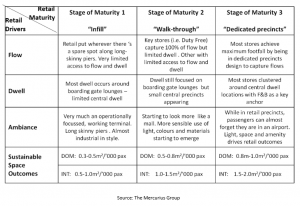

The table below highlights the evolution of travel retail. It can be interpreted at an individual airport level as well as at an industry level. The airports sustaining the most retail tend to be those at Stage 3 of their maturity – those airports that are creating retail precincts with a retail (rather than transport) ambiance and giving their retail programs the benefit of 100% footfall and 100% dwell (or near as possible to that).

Source: The Mercurius Group

The Mercurius Group’s experience in working with airports is that the precise amount of retail that is sustainable always depends on a range of factors including terminal design (for things like pax flow and dwell patterns), passenger volume and mix (nationality, reason for travel, haul length, socio-economics, demographics) and local circumstantial factors. But without exception, in all of our products, we have been able to work with planners, architects and designers to find a way to make more retail sustainable than previously thought possible, generating incremental returns for the airport. The earlier we get involved in a project (before views on constraints to retail get entrenched) the better. The Mercurius Group’s approach is to monetise changes in retail layout and design – that is, we can “value” two (or more) different terminal designs/layouts from a retail perspective. This helps focus the mind on things that really matter.

For a more detailed discussion on how we can help assess how much retail is enough for your airport, please call Ivo Favotto on +61 423 564 057.

Hospital Retail Integration Hospital as a Harmonious Symphony Imagine a hospital as a finely tuned orchestra, where each instrument plays a cruci...

Read MoreThe short answer is they can and soon will do so as this non-traditional revenue stream become more important to administrators and become a fund...

Read MoreThriving Metropolis: The Benefits of Hospital Retail Facilities Imagine a hospital as a thriving metropolis, with every corridor bustling like a ...

Read More