The short answer is they can and soon will do so as this non-traditional revenue stream become more important to administrators and become a fundamental component of any new or refurbished hospital feasibility study.

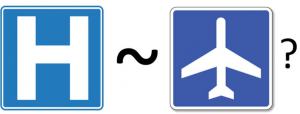

The similarities between hospitals and airports are quite marked. Like airports, hospitals are places where large numbers of people aggregate and hang around for long periods of time – the key preconditions to a successful infrastructure retail program as most airports have known for the past 25 years.

Sure, there are differences – hospitals are not airports. Airports are largely joyous places – lots of people embarking on (mostly) exciting journeys – and hospitals are, well, for the most part less joyous. So, while it’s unlikely a hospital will ever have a luxury fashion boutique, that doesn’t mean there aren’t significant retail opportunities.

From a retail perspective the key question needing and answer is – how many people are there at hospitals and how long do they hang around there?

This is the question The Mercurius Group had to answer in a recent retail planning project conducted for NSW Health Infrastructure.

Take Westmead Hospital as an example. It is one of Australia’s largest hospitals and serving one of Australia’s largest and fastest growing population areas, Western Sydney. It is part of what has become known as the Westmead Health Precinct, which a recent Deloitte report estimated employs more than 18,000 people.

The Deloitte report, commissioned by the Westmead Alliance – a grouping of major public and private sector bodies with an interest in the precinct – found that by 2036 the precinct is forecast to employ more than 50,000 people.

A major redevelopment of the precinct is planned that includes a commitment of billions of dollars for major projects like the Central Acute Services Building (effectively a joint Emergency Department in between Westmead Hospital and the Children’s Hospital Westmead, multi-storey car park development and expansions of the Sydney University and Western Sydney University campuses.

To put this into context, by 2036, there will be just as many employees at Westmead Hospital as there are currently at Sydney Airport (counting all businesses on airport including the airport company itself as well as airlines, ground handlers, maintenance organisations, police, fire/rescue and retail employees). Even today, there are just as many employees at Westmead as there are at major regional airports such as Adelaide.

And on top of all this, there are visitors –lots of them. Not just people visiting patients, but outpatients, management people, construction people and commercial visitors. Hospitals are a hive of activity every day. The number of visitors is a multiple of the number of staff, each and every day.

And from a dwell perspective, these people can hang around for long periods. In airport retail length and location of dwell is a critical factor in the success or failure of a retail programme. Staff tend to be at a hospital for long shifts and many visitors spend many hours there.

So given the large flows and the long dwells, hospitals should be ripe for retail development.

But they haven’t been. Why not?

The simple answer is that no-one seems to have seriously focused on this before.

Hospitals are where airports were 25 years ago – back then airport retail occupied dodgy and small c-grade spaces no operational department wanted. The spaces were filled with generic concepts with limited choice and poor quality. This is what – by and large – happens at hospitals today. The attitude to commercial space by hospital managers is eerily similar to past airport managers instead of “we are here to facilitate aircraft not be a shopping centre” the comment is “we are here to help sick people not to run a bunch of shops

But I firmly believe hospitals –like other infrastructure assets – can do both (i.e. run a hospital and a retail development). Modern infrastructure retail precincts offer hospital managers three key advantages:

However, building a modern infrastructure retail facility needs to be carefully planned. The Mercurius Group has developed an infrastructure retail planning model identifying eight key principles needing to be implemented to achieve good commercial outcomes.

Hospitals won’t develop airport-like retail programs overnight. However, the pressure to ensure the public are served by world leading health infrastructure means it will happen.

A mini revolution has already started in food and beverage with some high street brands starting to appear in hospitals and this will spread as hospitals start planning better spaces and the market gets better educated about the opportunities. And specialty retail will spread beyond newsagents and chemists and start serving the everyday retail needs of the thousands of people who spend their day there.

If you would like to understand how The Mercurius Group can help your hospital or infrastructure asset build a modern infrastructure retail program to grow revenue and improve amenity and convenience, please contact Mr Ivo Favotto on ifavotto@themercuriusgroup.com or by phone on +61 423 564 057.

Value Capture is a buzzword in the infrastructure world these days. Cash strapped governments seeking new ways to fund ever more expensive infr...

Read MoreIn April this year, I gave a presentation to the Trueventus Airport Retail conference in Singapore posing the question “How Much Retail Space i...

Read MoreOne is Australia’s business capital, the other the play capital. One has 5m inhabitants, the other 3.5m. One covers 12,500km2, the other 22...

Read More

Great article Ivo. Great insight into the opportunities for improved retail in hospitals. Makes sense for all stakeholders.